TurboTax Card: Ever wished getting your tax refund was as easy as swiping a card? This isn’t some far-off sci-fi dream – it’s the reality offered by the TurboTax Card. We’re diving deep into this convenient way to access your hard-earned money, covering everything from fees and activation to security and potential downsides. Get ready to learn if this prepaid card is the right fit for your tax season needs.

This guide breaks down the ins and outs of the TurboTax Card, comparing it to other refund options and highlighting key features. We’ll walk you through the process, address common concerns, and help you decide if this is the best way for you to receive your refund. Think of us as your friendly neighborhood tax refund experts – let’s get started!

TurboTax Card Availability

Getting your tax refund quickly is a major priority for most people, and the TurboTax card is one way to do just that. It offers a convenient and relatively fast way to receive your refund, but its availability isn’t universal. Let’s break down where you can get one and who qualifies.The TurboTax prepaid debit card is offered to eligible taxpayers in the United States.

This means that regardless of your state of residence, as long as you meet the requirements, you can opt to receive your refund onto a TurboTax card. There aren’t specific regional restrictions beyond the basic U.S. requirement. However, the actual processing and availability might vary slightly depending on your financial institution and the speed of the IRS processing your return.

Eligibility Criteria for Receiving a TurboTax Card

To receive a TurboTax card, you must first file your taxes using TurboTax software. Then, when choosing your refund method, you’ll have the option to select the prepaid debit card. Eligibility hinges primarily on your tax situation. Generally, you must meet the IRS’s requirements for receiving a tax refund and provide accurate information on your return.

Specific situations that might disqualify you could include errors on your return or issues with your banking information. The TurboTax software itself will guide you through the process and inform you of any potential issues that might prevent you from receiving a card.

Comparison with Other Tax Refund Options

The TurboTax card offers a different experience than other refund options like direct deposit or a paper check. Direct deposit is typically the fastest method, sending your refund directly into your bank account. However, not everyone has a bank account, making direct deposit inaccessible for some. Paper checks, while accessible to all, are notoriously slow. The TurboTax card sits somewhere in between.

It offers a faster alternative to a paper check and is convenient for those without bank accounts. The speed of receiving funds via the TurboTax card can be faster than a paper check but might be slightly slower than direct deposit, depending on various factors including processing times by the IRS and the issuing bank. The key advantage is convenience and accessibility for those who may not have a bank account or prefer not to use direct deposit.

TurboTax Card Fees and Charges

Okay, so you’re thinking about using a TurboTax prepaid debit card to get your tax refund. Smart move, right? But before you jump in, let’s talk about the fees. Knowing the costs upfront will help you decide if it’s the best option for you. We’ll break down the fees and compare them to other prepaid cards.

Using a TurboTax card usually involves a few potential fees, although some may be waived depending on the specific offer and your circumstances. These fees can vary from year to year, so always check the current terms and conditions before you file. It’s also important to compare these fees to those of other prepaid cards on the market to see if you’re getting a good deal.

So, I finally got my TurboTax card and am ready to tackle my taxes. I need to organize all my receipts, and to do that, I’m using a spreadsheet – I downloaded libre office download because it’s free and works great. Once I’ve got everything neatly categorized in LibreOffice Calc, importing it into TurboTax should be a breeze!

TurboTax Card Fee Breakdown

The fees associated with a TurboTax card can include activation fees, monthly maintenance fees, ATM fees, and fees for other services like balance inquiries or money transfers. The exact fees and whether they apply depend on the specific card you choose and any promotions running at the time. For example, some years there might be a promotional period where certain fees are waived.

Always read the fine print!

Comparison with Competing Prepaid Cards

Many prepaid debit cards exist, and their fee structures can vary widely. Some cards might offer lower fees for ATM withdrawals or have no monthly maintenance fees. Others might charge higher fees for certain transactions. It’s crucial to compare the TurboTax card’s fee schedule with those of other popular prepaid cards like those offered by NetSpend, Green Dot, or others to determine which one best fits your needs and spending habits.

Consider factors like how often you’ll use ATMs, whether you need international transaction capabilities, and the overall convenience of the card’s features.

TurboTax Card Fee Comparison Table

This table provides a hypothetical comparison, as actual fees can change. Always check the official websites for the most up-to-date information.

| Fee Type | TurboTax Card (Example) | NetSpend Card (Example) | Green Dot Card (Example) |

|---|---|---|---|

| Activation Fee | $0 (promotional) | $4.95 | $0 |

| Monthly Fee | $0 (if conditions met) | $5.00 | $4.95 |

| ATM Withdrawal Fee (out-of-network) | $2.00 | $2.50 | $1.50 |

| Balance Inquiry Fee (phone) | $0.50 | $1.00 | $0.75 |

TurboTax Card Activation and Usage

Getting your TurboTax refund onto a prepaid card is super convenient, but you’ll need to activate it first to start using it. Activation is a quick process that ensures your card is ready to use for purchases and withdrawals. Once activated, you can use your TurboTax card just like any other debit card.Activating and using your TurboTax card is pretty straightforward.

Think of it like setting up a new debit card—a few simple steps, and you’re ready to go. The card itself is a Visa or Mastercard, depending on the year and your specific circumstances, so it’s widely accepted.

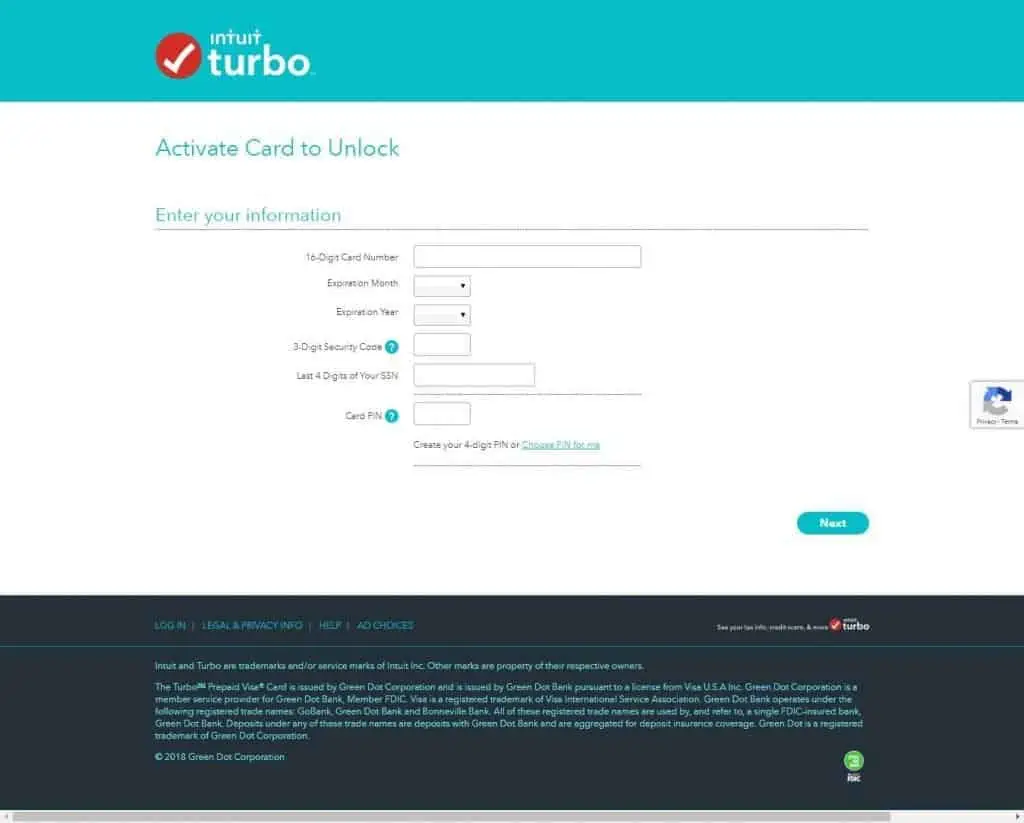

TurboTax Card Activation Steps

Activating your TurboTax card usually involves visiting the card issuer’s website or calling a designated phone number. You’ll need the card number and other information printed on the card itself. The exact steps might vary slightly depending on the year and the specific card issuer, so it’s best to check the instructions that came with your card. Generally, the process involves entering your card number, social security number (or other identifying information), and answering a few security questions.

You’ll then set a PIN for ATM and point-of-sale transactions. Always keep your PIN secure and confidential.

TurboTax Card Usage

Your TurboTax card functions similarly to a standard debit card. You can use it to make purchases at stores, online, or by phone wherever Visa or Mastercard debit cards are accepted. You can also withdraw cash from ATMs that accept these cards. Keep in mind that there might be fees associated with ATM withdrawals, so it’s a good idea to check the card’s terms and conditions for details.

You can also check your balance online or through the card issuer’s app.

Merchants and Services Accepting TurboTax Cards

The TurboTax card is a Visa or Mastercard debit card, meaning it’s accepted at a vast majority of merchants and services. This includes major retailers, restaurants, online stores, and gas stations. You can use it almost anywhere you would use a regular debit card. For example, you could use it at Target, Walmart, Amazon, or your local grocery store.

It can also be used to pay bills online if the merchant accepts debit card payments. Since it’s a widely accepted card network, the possibilities are extensive.

Security Features of TurboTax Card

Okay, so you’re thinking about using a TurboTax card to get your tax refund. Smart move, it’s usually pretty quick. But before you dive in, let’s talk security. Your hard-earned money is on the line, so understanding how the card protects your funds is crucial.The TurboTax card, like most prepaid debit cards, employs several security measures to safeguard your money.

These typically include EMV chip technology, which makes it harder for counterfeit cards to work at point-of-sale systems. They also often have robust online account management portals where you can monitor transactions, set spending limits, and even freeze the card if it’s lost or stolen. This level of control puts you in the driver’s seat when it comes to your finances.

Comparison of Security Features with Other Prepaid Cards

Many prepaid cards offer similar security features, such as EMV chips and online account management. However, the specific features and their robustness can vary significantly between providers. Some cards might offer additional features like fraud alerts or purchase restrictions, while others may have more basic security protocols. It’s always a good idea to compare the security features of different prepaid cards before making a decision, checking the fine print to see what protections are in place.

For instance, some cards offer purchase limits for specific categories like gambling or alcohol, adding an extra layer of protection against unauthorized spending.

Potential Security Risks and Mitigation Strategies

While TurboTax cards incorporate various security measures, potential risks still exist. Phishing scams, where fraudsters attempt to trick you into revealing your card details, are a common concern. Also, losing or having your card stolen is always a possibility. To mitigate these risks, it’s essential to be vigilant about suspicious emails or text messages. Never share your card number, PIN, or other sensitive information with anyone you don’t trust.

Additionally, consider activating online account alerts, which can notify you of unusual activity on your card. If your card is lost or stolen, report it immediately to the issuer to prevent unauthorized transactions. Remembering to regularly review your account statements for any suspicious activity is also a crucial step in maintaining your financial security.

TurboTax Card Customer Support

Getting help with your TurboTax card is straightforward, with several avenues available to address any questions or concerns you might have. Whether you’re having trouble activating your card, need to check your balance, or are facing an unexpected issue, there are resources designed to assist you. Remember, proactive problem-solving can save you time and frustration.

TurboTax offers a multi-faceted approach to customer support, ensuring accessibility for a wide range of users. This includes phone support, online help centers, and FAQs, providing a variety of options to best suit your needs and preferred method of communication.

Available Customer Support Channels

TurboTax provides several ways to contact customer support for assistance with your prepaid debit card. Choosing the right channel depends on the urgency of your issue and your personal preference.

- Phone Support: A dedicated phone number is available during specified business hours. This is ideal for urgent issues requiring immediate attention or for situations where a detailed explanation is needed. Representatives can guide you through troubleshooting steps and resolve problems in real-time.

- Online Help Center: A comprehensive online help center provides answers to frequently asked questions, troubleshooting guides, and tutorials. This self-service option is available 24/7 and allows you to find solutions at your own pace.

- Email Support: While not always the fastest method, email support allows you to detail your issue thoroughly and receive a written response. This is useful for less urgent problems or for situations requiring documentation.

Common Customer Support Issues and Resolutions

Many common issues surrounding TurboTax cards can be resolved quickly and easily. Understanding these common problems and their solutions can help you proactively address any challenges you may encounter.

| Issue | Resolution |

|---|---|

| Card Activation Problems | Check the card’s activation instructions carefully. If still facing issues, contact customer support via phone or online chat for assistance. They may need to verify your identity and provide further instructions. |

| Lost or Stolen Card | Immediately report the loss or theft to TurboTax customer support. They will guide you through the process of cancelling the card and issuing a replacement. |

| Incorrect Balance | Verify the balance through the online portal or by calling customer support. Discrepancies can sometimes arise due to pending transactions or processing delays. |

| Transaction Disputes | Gather all relevant documentation, including transaction details and any supporting evidence. Contact customer support to initiate a dispute resolution process. |

Frequently Asked Questions about TurboTax Card Support

Here are answers to some of the most frequently asked questions regarding TurboTax card support. Reviewing these questions beforehand might prevent you from needing to contact support at all.

- What are the customer support hours? Customer support hours typically vary depending on the season (busier during tax season). Check the TurboTax website for the most up-to-date information.

- How long does it take to receive a response to an email? Response times for email support can vary, but generally, you can expect a response within 1-3 business days.

- What information do I need to provide when contacting customer support? Be prepared to provide your card number, the last four digits of your social security number, and a brief description of your issue.

- What if my issue is not resolved after contacting support? If your issue remains unresolved, escalate the problem by requesting to speak with a supervisor or manager. You can also explore filing a complaint with the appropriate regulatory agency if necessary.

TurboTax Card Refund Processing Time

Getting your tax refund quickly is a major plus, and the TurboTax card offers a potentially fast way to access your money. However, the actual speed depends on several factors, so understanding the timeline is key. This section details the typical processing time and compares it to other refund methods.The typical processing time for a tax refund loaded onto a TurboTax prepaid debit card is generally faster than receiving a paper check, but it can still take some time.

While the IRS processes your return, the anticipation can be intense! Once the IRS approves your return and sends the refund to the card issuer, it usually takes a few business days for the funds to be available. This contrasts with direct deposit, which typically sees funds available in your account within 1-3 business days of IRS approval.

However, unlike a paper check, you won’t have to wait for the mail.

Refund Processing Time Compared to Other Methods

Direct deposit is usually the fastest method for receiving your tax refund. The funds are electronically transferred directly into your bank account, often within 1-3 business days of IRS approval. A paper check, on the other hand, can take several weeks, depending on mail delivery times. The TurboTax card falls somewhere in between – faster than a check but potentially slower than direct deposit, depending on various factors.

Think of it as a happy medium: faster than snail mail, but maybe not quite as instantaneous as direct deposit.

Factors Affecting Refund Processing Speed

Several factors can influence how quickly your refund hits your TurboTax card. The IRS processing time is the biggest variable. A simple return with no errors will process much faster than a complex return requiring additional review. The IRS’s workload during tax season also plays a significant role; during peak times, processing can take longer. Additionally, any issues with your return, such as missing information or discrepancies, will cause delays.

Finally, the card issuer’s processing time adds a small window of time to the overall process. Think of it like a relay race – each leg contributes to the total time. A small hiccup in any part of the process can impact the overall speed.

TurboTax Card Alternatives

So, you’re thinking about getting your tax refund, but maybe the TurboTax card isn’t quite your cup of tea. That’s totally understandable! There are a few other ways to get that money, each with its own perks and downsides. Let’s take a look at some alternatives and compare them to the TurboTax card.Getting your tax refund doesn’t have to mean using a prepaid debit card.

Several methods offer different benefits depending on your needs and preferences. Understanding these options allows you to make an informed decision that best suits your financial situation.

Direct Deposit

Direct deposit is the most common and often fastest way to receive your tax refund. The IRS directly transfers the funds into your designated bank account. This method avoids the fees associated with other refund options and usually provides the quickest access to your money. However, it requires having a bank account and providing accurate banking information to the IRS.

If you provide incorrect details, your refund could be delayed.

Paper Check

A paper check is a more traditional method, but it can take longer to receive your refund compared to direct deposit. There’s also a risk of lost or stolen mail, which could cause delays or complications. While it doesn’t require a bank account, it introduces potential security risks and the inconvenience of waiting for the mail.

Alternative Prepaid Debit Cards

Several other prepaid debit cards exist beyond the TurboTax card, each offering varying features and fees. Some may offer better rewards programs or lower fees, but it’s crucial to research and compare them carefully before choosing one. These cards often have activation and usage fees, similar to the TurboTax card.

Comparison of Refund Options

Here’s a table summarizing the key differences between the TurboTax card and other refund options:

| Method | Speed | Fees | Requires Bank Account | Security Risks |

|---|---|---|---|---|

| TurboTax Card | Relatively fast | Potential activation and usage fees | No | Potential for fraud if card is lost or stolen |

| Direct Deposit | Fastest | Generally none | Yes | Low, if bank security measures are followed |

| Paper Check | Slowest | Generally none | No | Risk of lost or stolen mail |

| Other Prepaid Cards | Relatively fast | Varying fees | No | Potential for fraud if card is lost or stolen |

TurboTax Card and Tax Software Integration

Getting your tax refund quickly and easily is a major goal for many, and the TurboTax card helps streamline that process. The integration between the TurboTax software and the card options is designed to make receiving your refund as seamless as possible, directly within the familiar environment of the tax preparation program. This integration eliminates the need for separate applications or websites, centralizing the entire refund process.The TurboTax software allows users to select their preferred refund disbursement method during the tax filing process.

This choice is typically presented near the end of the filing process, after you’ve completed all the necessary tax information. You’ll see clear options, including direct deposit to your bank account, a check mailed to your address, or receiving your refund onto a TurboTax prepaid debit card. Choosing the card option initiates the process of linking the card to your tax return.

TurboTax Card Linking Process

Linking a TurboTax card to your tax return is a straightforward process within the TurboTax software. After selecting the TurboTax card as your preferred refund disbursement method, the software will prompt you to provide the necessary information associated with your card. This might include the card number, expiration date, and possibly a security code (though this is not always required, depending on the specific card and software version).

The software will then verify the information to ensure the accuracy of the data. Once verified, your refund will be directed to that specific card. It’s crucial to double-check all the information before submitting your return to avoid any delays or issues with receiving your refund. Any discrepancies could result in processing delays. The software often provides confirmation messages and may even offer a summary of your refund disbursement information for review before final submission of your tax return.

TurboTax Card Limitations and Restrictions

Okay, so you’re thinking about using a TurboTax debit card to get your tax refund. That’s cool, but like any financial product, there are some things to keep in mind. It’s not all sunshine and rainbows (though a quick refund is pretty sweet!). Let’s look at some of the limitations you might encounter.The TurboTax card, while convenient, isn’t a magic money-making machine.

It has specific rules and boundaries you need to be aware of before you jump in. Understanding these limitations will help you decide if it’s the right choice for you.

Geographical Limitations

The TurboTax card is primarily available for use within the United States. This means you won’t be able to easily use it for purchases or withdrawals in other countries. While you might be able to use it in some international ATMs, you’ll likely face hefty foreign transaction fees, making it a pretty expensive option compared to other travel-friendly cards.

Think about that summer trip to Europe – you’ll probably want a different card for that.

Transaction Limits and Fees

There are limits on how much money you can withdraw or spend using your TurboTax card within a given period. These limits vary and are typically set by the issuing bank (Green Dot Bank, for example). Exceeding these limits could result in declined transactions or additional fees. For example, there might be a daily limit on ATM withdrawals, or a monthly limit on the total amount you can spend.

These fees can quickly add up, so it’s crucial to check the card’s terms and conditions for specific details on these limitations and associated charges. Failing to do so could lead to unexpected costs that eat into your hard-earned refund.

Other Restrictions

Beyond geographical limitations and transaction limits, there might be other restrictions depending on the specific card you receive. These could include restrictions on the types of transactions allowed (for example, some cards might not work with certain online merchants). Also, keep in mind that the card’s functionality might be limited compared to a standard debit card. For instance, you might not be able to directly link it to certain online payment systems or use it for recurring bill payments.

Always check the cardholder agreement for a complete list of restrictions. It’s a bit of a legal document, but it’s worth the read to avoid any unpleasant surprises.

TurboTax Card User Reviews and Feedback

Online reviews offer a valuable glimpse into the real-world experiences of TurboTax card users. Analyzing this feedback helps potential users make informed decisions and highlights areas where the card excels or falls short. The overall sentiment is mixed, with a range of positive, negative, and neutral experiences reported.

User reviews are scattered across various online platforms, including the TurboTax website itself, independent review sites like Trustpilot and Yelp, and social media. This diverse range of sources provides a comprehensive picture of user satisfaction, though it’s important to note that individual experiences can vary significantly.

Positive User Feedback

Positive reviews frequently praise the convenience and speed of receiving tax refunds via the TurboTax card. Many users appreciate the quick access to their money, especially those who need funds urgently. The prepaid nature of the card is also often cited as a benefit, particularly for those without traditional bank accounts. For example, one user commented, “Got my refund so fast! It was a lifesaver.” Another stated, “Easy to use and much faster than a direct deposit.”

Negative User Feedback

Conversely, negative feedback often centers around fees and customer service. Some users complain about unexpected charges, while others express frustration with the difficulty of contacting customer support or resolving issues with the card. For example, a common complaint is about activation fees or difficulties accessing funds. One review stated, “The fees were hidden, and I ended up paying more than I expected.” Another user commented, “Customer service was unhelpful and difficult to reach.”

Neutral User Feedback

Neutral reviews often describe the TurboTax card as a functional but not exceptional product. These users highlight neither significant positives nor negatives, simply stating that the card worked as expected without any major issues. Many users in this category simply describe the card as a “convenient option” without elaborating on specific positive or negative experiences. For instance, a neutral review might read, “It did the job, got my refund, no problems.”

TurboTax Card Legal and Regulatory Compliance

The TurboTax card, like any prepaid debit card, operates within a complex web of legal and regulatory frameworks designed to protect consumers and ensure fair financial practices. These regulations cover various aspects, from the card’s issuance and usage to the handling of consumer funds and data security. Understanding these regulations is crucial for both Intuit (the company behind TurboTax) and the cardholders.The issuance and use of the TurboTax card are primarily governed by federal and state laws related to banking, consumer protection, and data privacy.

Key regulations include the Electronic Fund Transfer Act (EFTA), the Truth in Lending Act (TILA), and state-specific regulations concerning prepaid cards and consumer financial products. Intuit, as the issuer, must adhere to these regulations to ensure the card operates legally and ethically. Failure to comply can result in significant penalties and reputational damage.

Compliance with Federal Financial Regulations

The Electronic Fund Transfer Act (EFTA) dictates how electronic fund transfers, including those involving prepaid cards like the TurboTax card, are handled. This includes regulations on error resolution, liability for unauthorized transactions, and disclosure requirements. The Truth in Lending Act (TILA) mandates clear and accurate disclosure of fees and terms associated with the card, protecting consumers from hidden charges.

Intuit must comply with these acts by providing transparent fee schedules, readily available dispute resolution processes, and clear communication regarding the card’s terms and conditions. Regular audits and compliance reviews are essential to maintaining adherence to these regulations. For example, clear disclosure of fees like activation fees, monthly maintenance fees, and ATM withdrawal fees are mandated by TILA.

The EFTA ensures that consumers have recourse in case of errors in transactions, and their liability is limited in case of unauthorized use.

Responsibilities of TurboTax and Cardholders

Intuit, as the issuer, bears the primary responsibility for ensuring the TurboTax card complies with all relevant legal and regulatory requirements. This includes maintaining accurate records, implementing robust security measures, and providing clear and accessible information to cardholders. Cardholders, in turn, have a responsibility to understand the terms and conditions of the card, use it responsibly, and report any suspicious activity or errors promptly.

This shared responsibility contributes to a secure and compliant system. For instance, Intuit is responsible for adhering to data privacy regulations like the Gramm-Leach-Bliley Act (GLBA), protecting cardholder personal and financial information. Meanwhile, cardholders are responsible for safeguarding their card PIN and reporting any unauthorized transactions immediately.

State-Specific Regulations

Beyond federal regulations, the TurboTax card’s operations are also subject to various state-specific laws and regulations governing financial institutions and consumer protection. These regulations may vary significantly from state to state, impacting aspects like fee structures, disclosure requirements, and consumer recourse mechanisms. Intuit must navigate these complexities to ensure compliance across all jurisdictions where the card is offered. For example, some states might have stricter rules regarding the disclosure of fees or the process for disputing transactions.

Intuit must adapt its practices to meet these varying requirements.

Final Summary

Ultimately, the TurboTax Card offers a fast and convenient way to receive your tax refund, but it’s crucial to weigh the pros and cons against other options. Consider your financial habits, security preferences, and the associated fees to make an informed decision. By understanding the nuances of this prepaid card, you can confidently choose the method that best suits your needs and makes tax season a little less stressful.

Happy filing!

Common Queries

Can I use my TurboTax Card internationally?

Generally, no. Most prepaid cards have restrictions on international use. Check the card’s terms and conditions for specifics.

What happens if my TurboTax Card is lost or stolen?

Report it immediately to the customer service number on the back of the card. They’ll guide you through the process of canceling the card and getting a replacement.

Are there any transaction limits on the TurboTax Card?

Yes, there might be daily or monthly spending limits. Check your card agreement for details. Exceeding these limits might incur fees.

Can I reload my TurboTax Card after my refund is deposited?

No, TurboTax Cards are typically single-use and cannot be reloaded.

How long does it take to receive my TurboTax Card after filing?

The delivery time varies depending on your location and the shipping method. Check the estimated delivery timeframe provided during the filing process.